Pocket Option Tax . if you're new to options trading, you may be wondering how those trades are taxed. Here is everything you need to know and how you can calculate your potential tax liability. taxes the company is not a tax agent and does not provide the clients' financial information to any third parties. 100+ assets for tradingfree practice figuring out taxes on your options trades can be complex, but there are legal ways to reduce what you owe. confused about how your options trading investments will be taxed? gains and losses on call and put options can be subject to capital gains tax or income tax. 100+ assets for tradingfree practice Here's a rundown of some potential tax pitfalls with options strategies. stock options are taxed or the loss is deducted when the holder of a company's stock sells the stock they bought when they exercised their stock.

from www.youtube.com

Here's a rundown of some potential tax pitfalls with options strategies. 100+ assets for tradingfree practice if you're new to options trading, you may be wondering how those trades are taxed. figuring out taxes on your options trades can be complex, but there are legal ways to reduce what you owe. taxes the company is not a tax agent and does not provide the clients' financial information to any third parties. stock options are taxed or the loss is deducted when the holder of a company's stock sells the stock they bought when they exercised their stock. gains and losses on call and put options can be subject to capital gains tax or income tax. confused about how your options trading investments will be taxed? 100+ assets for tradingfree practice Here is everything you need to know and how you can calculate your potential tax liability.

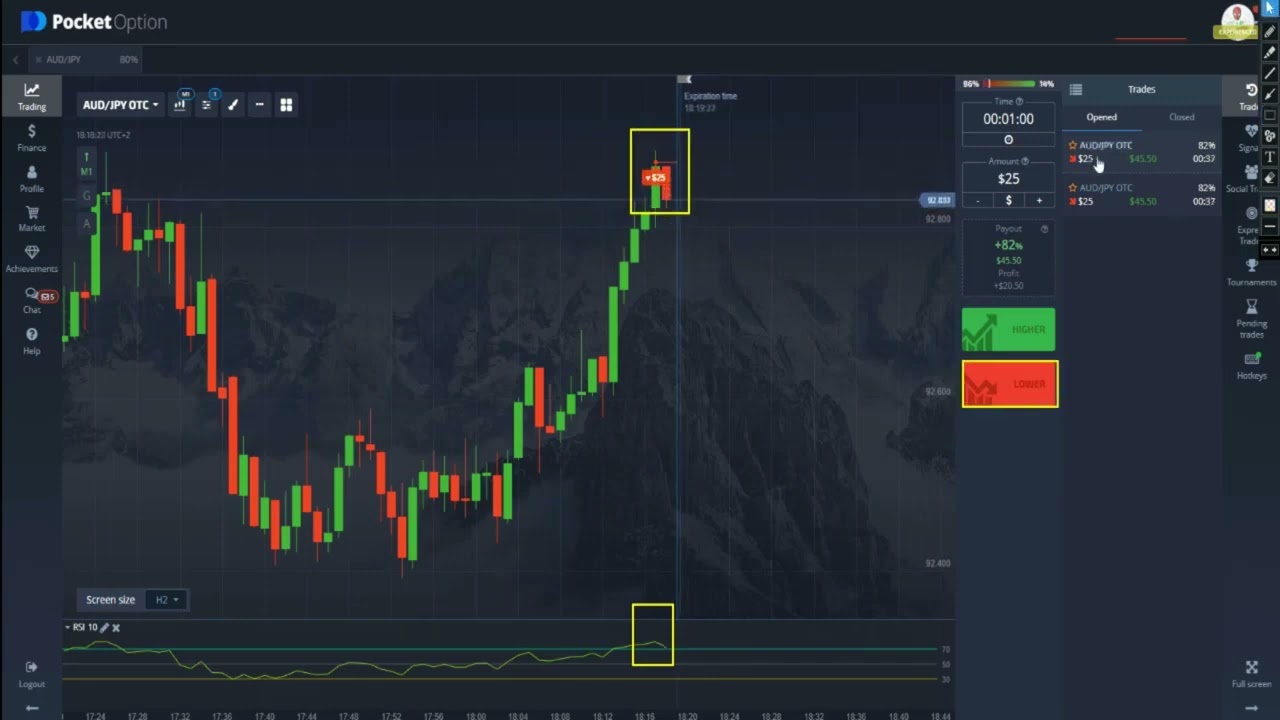

Pocket Option Strategy RSI 10 Quick analyzing & Effective trade for

Pocket Option Tax figuring out taxes on your options trades can be complex, but there are legal ways to reduce what you owe. Here's a rundown of some potential tax pitfalls with options strategies. gains and losses on call and put options can be subject to capital gains tax or income tax. 100+ assets for tradingfree practice figuring out taxes on your options trades can be complex, but there are legal ways to reduce what you owe. stock options are taxed or the loss is deducted when the holder of a company's stock sells the stock they bought when they exercised their stock. Here is everything you need to know and how you can calculate your potential tax liability. 100+ assets for tradingfree practice taxes the company is not a tax agent and does not provide the clients' financial information to any third parties. confused about how your options trading investments will be taxed? if you're new to options trading, you may be wondering how those trades are taxed.

From pocketoption-fx.com

Pocket Option FX Official Site and Signals Pocket Option Tax gains and losses on call and put options can be subject to capital gains tax or income tax. if you're new to options trading, you may be wondering how those trades are taxed. 100+ assets for tradingfree practice stock options are taxed or the loss is deducted when the holder of a company's stock sells the stock. Pocket Option Tax.

From www.youtube.com

Pocket Option Strategy No Loss Binary Options Trading YouTube Pocket Option Tax 100+ assets for tradingfree practice Here's a rundown of some potential tax pitfalls with options strategies. confused about how your options trading investments will be taxed? Here is everything you need to know and how you can calculate your potential tax liability. stock options are taxed or the loss is deducted when the holder of a company's stock. Pocket Option Tax.

From www.youtube.com

Pocket Option Bot 1 Minute Trading Strategy No Loss 100 Work YouTube Pocket Option Tax 100+ assets for tradingfree practice Here's a rundown of some potential tax pitfalls with options strategies. figuring out taxes on your options trades can be complex, but there are legal ways to reduce what you owe. gains and losses on call and put options can be subject to capital gains tax or income tax. if you're new. Pocket Option Tax.

From www.youtube.com

Easy Pocket Option Trading Strategy // Breakout Tutorial for beginners Pocket Option Tax 100+ assets for tradingfree practice Here is everything you need to know and how you can calculate your potential tax liability. 100+ assets for tradingfree practice confused about how your options trading investments will be taxed? gains and losses on call and put options can be subject to capital gains tax or income tax. Here's a rundown of. Pocket Option Tax.

From metaverso-virtual.com

Pocket Option Opiniones 2024 Bróker España ¿Estafa? Pocket Option Tax Here is everything you need to know and how you can calculate your potential tax liability. taxes the company is not a tax agent and does not provide the clients' financial information to any third parties. gains and losses on call and put options can be subject to capital gains tax or income tax. Here's a rundown of. Pocket Option Tax.

From ultimatefxtools.com

Pocket Option Pocket Option Powerful 15 Seconds Strategy Pocket Option Tax figuring out taxes on your options trades can be complex, but there are legal ways to reduce what you owe. 100+ assets for tradingfree practice stock options are taxed or the loss is deducted when the holder of a company's stock sells the stock they bought when they exercised their stock. Here is everything you need to know. Pocket Option Tax.

From www.youtube.com

Pocket Option Tutorial [ FULL TRADING GUIDE ] 📈 How to use it correctly Pocket Option Tax gains and losses on call and put options can be subject to capital gains tax or income tax. 100+ assets for tradingfree practice Here's a rundown of some potential tax pitfalls with options strategies. confused about how your options trading investments will be taxed? if you're new to options trading, you may be wondering how those trades. Pocket Option Tax.

From www.cambiodivisas.net

Pocket Option Opiniones 2024 Analizamos el bróker ¿Estafa Pocket Option Tax taxes the company is not a tax agent and does not provide the clients' financial information to any third parties. stock options are taxed or the loss is deducted when the holder of a company's stock sells the stock they bought when they exercised their stock. if you're new to options trading, you may be wondering how. Pocket Option Tax.

From www.investingstockonline.com

Frequently Asked Questions on Pocket Option Investing stock online Pocket Option Tax confused about how your options trading investments will be taxed? figuring out taxes on your options trades can be complex, but there are legal ways to reduce what you owe. 100+ assets for tradingfree practice taxes the company is not a tax agent and does not provide the clients' financial information to any third parties. Here's a. Pocket Option Tax.

From www.binaryoptions.com

Pocket Option bonus review ++ Guide & conditions (2022) Pocket Option Tax figuring out taxes on your options trades can be complex, but there are legal ways to reduce what you owe. if you're new to options trading, you may be wondering how those trades are taxed. 100+ assets for tradingfree practice Here's a rundown of some potential tax pitfalls with options strategies. Here is everything you need to know. Pocket Option Tax.

From www.youtube.com

How to create account in pocket option pocket option account kaise Pocket Option Tax Here's a rundown of some potential tax pitfalls with options strategies. 100+ assets for tradingfree practice taxes the company is not a tax agent and does not provide the clients' financial information to any third parties. if you're new to options trading, you may be wondering how those trades are taxed. stock options are taxed or the. Pocket Option Tax.

From www.youtube.com

Pocket Option Strategy RSI 10 Quick analyzing & Effective trade for Pocket Option Tax 100+ assets for tradingfree practice confused about how your options trading investments will be taxed? gains and losses on call and put options can be subject to capital gains tax or income tax. Here is everything you need to know and how you can calculate your potential tax liability. taxes the company is not a tax agent. Pocket Option Tax.

From deala.com

Pocket Option Review Is it a Reliable Broker for Trading? DealA Blog Pocket Option Tax taxes the company is not a tax agent and does not provide the clients' financial information to any third parties. 100+ assets for tradingfree practice if you're new to options trading, you may be wondering how those trades are taxed. stock options are taxed or the loss is deducted when the holder of a company's stock sells. Pocket Option Tax.

From www.publicfinanceinternational.org

Pocket Option Review 2024 Is it Safe and Legit or a Scam? Pocket Option Tax confused about how your options trading investments will be taxed? Here is everything you need to know and how you can calculate your potential tax liability. if you're new to options trading, you may be wondering how those trades are taxed. Here's a rundown of some potential tax pitfalls with options strategies. 100+ assets for tradingfree practice . Pocket Option Tax.

From www.youtube.com

50 To 30k Pocket Option SECRET Strategy Binary Option Trading EP1 Pocket Option Tax taxes the company is not a tax agent and does not provide the clients' financial information to any third parties. Here is everything you need to know and how you can calculate your potential tax liability. 100+ assets for tradingfree practice Here's a rundown of some potential tax pitfalls with options strategies. gains and losses on call and. Pocket Option Tax.

From fnembrasil.org

Pocket Option é confiavel? O que é e como funciona? Bônus 50 [2023] Pocket Option Tax if you're new to options trading, you may be wondering how those trades are taxed. 100+ assets for tradingfree practice confused about how your options trading investments will be taxed? figuring out taxes on your options trades can be complex, but there are legal ways to reduce what you owe. stock options are taxed or the. Pocket Option Tax.

From www.youtube.com

How to use the Pocket Option demo account (Tutorial & Review for Binary Pocket Option Tax 100+ assets for tradingfree practice if you're new to options trading, you may be wondering how those trades are taxed. figuring out taxes on your options trades can be complex, but there are legal ways to reduce what you owe. taxes the company is not a tax agent and does not provide the clients' financial information to. Pocket Option Tax.

From top10finance.net

Pocket Option Review Top10Finance Pocket Option Tax taxes the company is not a tax agent and does not provide the clients' financial information to any third parties. gains and losses on call and put options can be subject to capital gains tax or income tax. Here's a rundown of some potential tax pitfalls with options strategies. 100+ assets for tradingfree practice confused about how. Pocket Option Tax.